What Are Commodities?

The commodities market is one of the oldest markets in existence. In fact, the Amsterdam Stock Exchange which emerged in 1530, is believed to be the first stock market in history and is often seen as a commodities market. How did this ancient sector evolve? What’s the history behind it and how can you trade commodities? In this article we’ll address these inquiries.

What Do Commodities Affect?

Commodities can be defined as commercial products that appear naturally in the ground or are agriculturally cultivated. Commodities play a key role in determining the prices of other financial markets as commodities are used as input in the manufacturing process - meaning national economies in general, and publicly-listed companies in particular, are affected by their prices. Changes in the prices of commodities tend to affect the entire supply chain. A good example of this is when the price of crude oil rises due to geopolitical upheaval in the major oil-producing countries. During the 1970s energy crisis, the price of crude oil rose sharply as a result of the “oil embargo” placed on the USA by members of the Organization of Arab Petroleum Exporting Countries (OAPEC). The embargo resulted in oil prices rising dramatically, causing severe inflation throughout the global economy. A more recent account of this effect is natural gas reaching its highest level in more than 13 years on April 18th, 2022 due to the Russia invasion of Ukraine.

The History of Commodity Exchanges

The Chicago Board of Trade (CBOT) was founded in 1848 and is the oldest futures and options exchange in the world. The exchange deals mainly with commodities such as corn, ethanol, gold, oats, rice, silver, soybeans and wheat.

However, it should be noted that CBOT was merged with the Chicago Mercantile Exchange (CME) in 2007 to form the CME Group. The Chicago Mercantile Exchange (CME) was initially established in 1898 as a leading agricultural commodities exchange known as the Chicago Butter and Egg Board. The CME is now the largest futures and options exchange in the world and offers various commodity futures as well as financial derivatives on products including currencies and interest rates.

The New York Board of Trade (NYBOT) was founded in 1870 as the New York Cotton Exchange. Later, in 2004, it merged with the Coffee, Sugar and Cocoa Exchange (CSCE) to form the NYBOT. Today, the NYBOT deals primarily in futures and options contracts for physical commodities such as cocoa, coffee, cotton, sugar and orange juice. It also deals in currency trading, interest rates and market indices.

An early version of the New York Mercantile Exchange (NYMEX) was established in 1872 dealing in dairy products. By 1994, NYMEX merged with the Commodity Exchange (COMEX) to become the largest physical commodity exchange of its time. However, as a result of the global financial crisis in 2008, it merged once again with the CME Group of Chicago. For commodity trading outside of the USA, the main exchanges are the London International Financial Futures and Options Exchange (LIFFE), the London Metal Exchange and the Tokyo Commodity Exchange.

Main Classification of Commodities

Commodities can broadly be classified into two main types, 'Hard Commodities' and 'Soft Commodities'. Hard commodities refer to commodities that require extraction or mining. Examples of these commodities include iron ore, crude oil and precious metals. Soft commodities, on the other hand, are typically agricultural products like coffee, corn, cotton, wheat and livestock such as live cattle. Furthermore, soft commodities are considered the oldest traded types of commodities and also go by the name ‘softs,’ ‘tropical commodities,’ or ‘food and fibre commodities.’

Sub Classification of Commodities

Commodities can be further classified into several sub-categories such as agricultural commodities, (wheat, soybeans and sugar). The sub-category “Energies” refers to commodities such as crude oil, heating oil, gasoline and natural gas. Metal commodities can be grouped into precious metals such as gold, Silver and platinum, or base (non-precious) metals such as copper and aluminium. “Livestock commodities” refers to meat products such as feeder cattle, live cattle and lean hogs.

How Can You Trade Commodities?

For those wishing to trade commodities, there are several ways to go about it - for example, you can trade futures contracts on a Futures Exchange. A futures contract is a contract which requires the contract holder to Buy or Sell a commodity at a fixed price at a future delivery date.

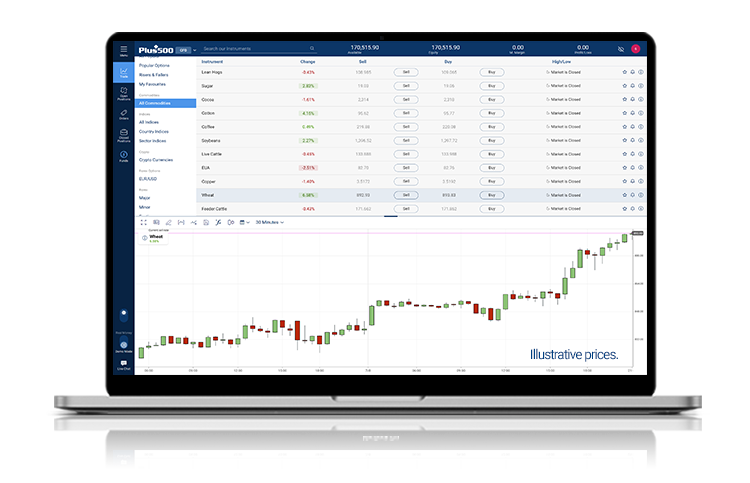

Alternatively, you can use CFDs to speculate on the price movements of commodities, as is the case on the Plus500 platform. Most commodity instruments offered by Plus500 are based on futures contracts from the world’s major exchanges. These include the Chicago Board of Trade (CBOT), the Chicago Mercantile Exchange (CME), the New York Board of Trade (NYBOT), the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE).

You can also trade CFDs on commodities-related stocks in order to gain exposure to the commodities market. For example, you can trade CFDs on companies like Exxon Mobil Corporation, Newmont Corporation, Rio Tinto, Southern Copper Corporation and more.

Illustrative prices.

This article contains general information which doesn't take into account your personal circumstances.